Invoice in German/Deutsch – Step by step and template

15.12.2023

Invoice in German/ Deutsch- Step by step and template

Does your company need to issue an invoice in German? Or are you doing business in Germany?

The invoice in Germany should contain the following information:

Vendor details:

- Company name or name of the seller

- The company address or residential address of the seller

- Tax identification number (USt-IdNr) of the seller, if availablBuyer’s data:

Byer`s data:

- Company name or name of the purchaser

- Company address or residence address of the buyer

- Purchaser’s tax identification number, if available

- Invoice number

- Unique invoice identification number

- Invoice date

- The period for which the invoice is issued (e.g., “Date of service: from [date] to [date]”).

- Description of goods or services provided:

- Quantity and type of goods or services

- Unit price

- Total (gross amount)

- Value of VAT rate (e.g., 19% or 7%)

- VAT amount calculated based on the rate and value of goods or services

- Total amount: Total to be paid, including VAT

- Payment method: Information on the method of payment, such as bank account number

- Payment date:The date by which the buyer must make payment

- Other information:Additional information, such as delivery terms, discounts, order number, etc.

- Seller’s signature and stamp (if required)

Remember that an invoice in Germany must be issued in accordance with local tax regulations, and you may be required to retain the invoices for a certain period of time for a possible tax audit.

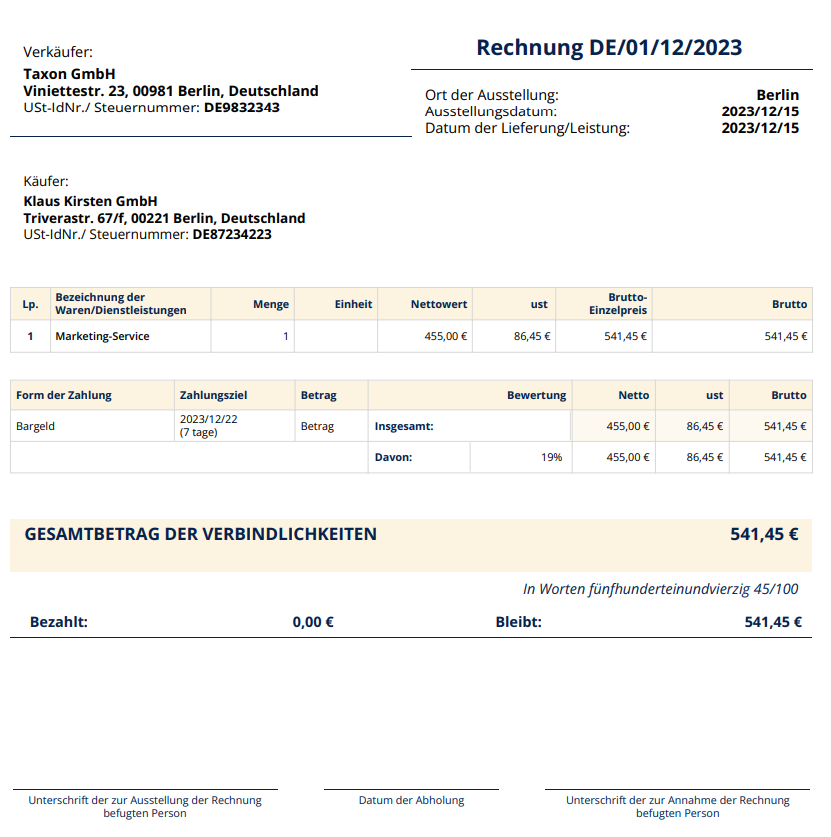

Invoice in Germany – template

In Germany, there is no specific template that must be used for invoices. However, invoices must contain certain mandatory information, as we mentioned. Many businesses in Germany create their own customized invoice templates to include the required details.

To help you get started, here’s a simple template for an invoice in Germany

VAT Rates in Germany

- Standard VAT Rate: 19%

- This rate applies to most goods and services, including general consumer goods and services.

- Reduced VAT Rate: 7%

- The reduced rate applies to specific categories of goods and services, including but not limited to:

- Foodstuffs (excluding restaurant meals)

- Non-alcoholic beverages

- Books, newspapers, and magazines

- Hotel accommodations

- Certain cultural and entertainment events

- Medical products

- Agricultural supplies

- The reduced rate applies to specific categories of goods and services, including but not limited to:

Invoices in Russsia: Navigating through documents

0% or no VAT - which rate should be indicated on the invoice in Ukraine?

What VAT number on invoice in the Netherlands?

Unpaid invoice? What are your next steps and options?

Omitted invoice in the purchase ledger in Bulgaria

Correction invoice

Invoicing in Norway

Invoicing for small businesses: complex guidelines explained in simple terms

What you need to know about electronic invoicing in Romania

Corrective invoice in Poland - when is it necessary to issue such a document?